Regardless of frequent media reviews in regards to the excessive price of school, many college students pay a lot lower than the eye-catching sticker value. College students enrolled at four-year establishments residing away from their dad and mom face the very best sticker costs. However solely round 1 / 4 or fewer of these enrolled at public establishments (for state residents) or personal nonprofit four-year establishments pay that sticker value. The rest obtain monetary support. Even most high-income college students obtain merit-based support. How are they purported to understand how a lot they must pay?

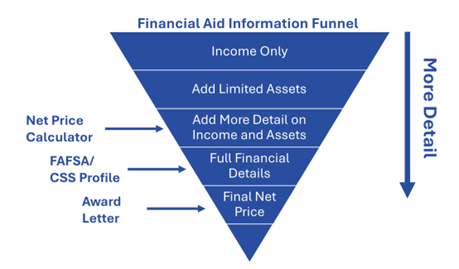

Right here is how schools and universities might assist. They’ll present college students with instruments that lead them by a monetary support “info funnel.” Present restricted monetary particulars (simply household earnings?) and get an on the spot ballpark estimate on the high of the funnel. Present a number of extra particulars, get a greater, however nonetheless ballpark estimate. Maintain going till you get an precise value. Excessive simplicity at the start of the method facilitates entry; the funnel ought to have a large mouth. If the result’s under sticker value, it may possibly promote additional investigation. Alongside the best way, constructive reinforcement by favorable outcomes (in the event that they happen) helps college students persevering with by the funnel.

Courtesy of Phillip Levine

This method represents a major advance over previous practices, as I element in a report newly launched by the Aspen Financial Technique Group (AESG). Traditionally, schools offered no preliminary estimates. College students filed their monetary support kinds (FAFSA and maybe CSS Profile), utilized to a school, and acquired their admissions determination and monetary support provide (if admitted) on the identical time. Who is aware of what number of college students didn’t trouble to use as a result of they believed they couldn’t afford it?

This started to alter in 2008. The Greater Training Act was amended at the moment to require establishments to supply “internet value calculators” by 2011 that have been supposed to supply early price estimates. Sadly, the well-intended coverage hasn’t been very efficient as a result of these instruments usually are not user-friendly. They could signify a helpful step greater up the funnel relative to the last word monetary support provide, however they continue to be towards its backside.

Different steps have been taken alongside the best way making an attempt to supply better pricing info to potential college students. The federal government launched new webpages (the School Navigator and the School Scorecard), which offer college-specific particulars concerning the common “internet value” (the quantity college students pay after factoring in monetary support). However the common internet value primarily helps college students with common funds decide their internet value. In addition to, utilizing the median somewhat than the common would reduce the influence of outliers. It’s a significantly better statistic to seize the quantity a typical pupil would pay on this context. Further information on internet costs inside sure earnings bands are additionally out there, however they nonetheless endure from the biases launched through the use of the common internet value as properly. What college students actually need and wish is an correct estimate of what school will price them.

The newest advance in school value transparency is the creation of the School Value Transparency Initiative. This effort represents the response of tons of of taking part establishments to a Authorities Accountability Workplace report detailing the inconsistency and lack of readability in monetary support provide letters. To take part, establishments agreed to sure rules and requirements within the provide letters they transmit. It’s an enchancment relative to previous apply, but it surely is also a bottom-of-the-funnel enchancment. It doesn’t present better value transparency to potential college students previous to submitting an utility.

Establishments have additionally engaged in different advertising actions designed to facilitate communication of affordability messaging. Some establishments have begun to supply gives of free tuition to college students with incomes under some threshold. The success of the Hail Scholarship (now repackaged because the Go Blue Assure) on the College of Michigan helps such an method. Many of those gives, although, don’t cowl residing bills, which is a selected downside for college kids residing away from their dad and mom. In these cases, such gives could also be extra deceptive than illuminating.

In 2017, I based MyinTuition Corp. as a nonprofit entity designed to supply pricing info greater up within the monetary support info funnel. Its unique software, now utilized by dozens of primarily extremely endowed personal establishments, requires customers to supply fundamental monetary inputs and obtain a ballpark value estimate. Extra lately, MyinTuition launched an on the spot internet value estimator, which is at present operational at Washington College in St. Louis, primarily based solely on household earnings. Given the restricted monetary particulars offered, these estimates embody some imprecision; the software additionally supplies a spread of estimates inside which the precise value is more likely to fall. These instruments are a straightforward entry level into the method, which is what the highest of the funnel is designed to perform. Extra such efforts are mandatory.

If we might do a greater job speaking the supply of monetary support, it will additionally contribute to better-informed public discussions about school pricing and entry. One current survey discovered that solely 19 p.c of adults appropriately acknowledged that lower-income college students pay much less to attend school than higher-income college students. It’s a respectable query to ask whether or not the value these college students pay is low sufficient. However we can’t even begin the dialogue with such restricted public understanding of how a lot college students throughout the earnings distribution pay now. Any step that schools and universities can take to facilitate that understanding could be useful. Bettering the transparency in their very own pricing definitely could be an essential step they’ll take.